Changeover costs refer to the expenses incurred during the transition period between your guests. These expenses may include:

- Cleaning

- Laundry and linen fees

- Replenishing toiletries

- A welcome pack

The welcome pack usually contains basic essentials such as tea, coffee, milk, and information about the local area.

To ensure your holiday let is equipped with fresh and clean linens for each guest, you’ll need to allocate a budget for laundry services. The cost will depend on the number of beds in the property and the quality of linens you provide. On average, laundry and linen fees could range from £30 to £60 per booking.

These guest changeover costs can vary, but a well-managed changeover may cost around £50 to £150 per booking.

How Much Do Holiday Let Cleaners Charge?

Holiday let cleaners play a crucial role in maintaining the property’s cleanliness and ensuring it meets guests’ expectations.

The cost of cleaning services can vary based on factors like property size, location, and specific requirements. On average, holiday let cleaners may charge between £15 to £30 per hour, and the cleaning cost per changeover could be in the range of £50 to £120.

Monthly Costs

Monthly costs for a holiday let can be broken down into several components:

1. Insurance:

Holiday let insurance is essential to protect your investment.

The average annual cost of holiday let insurance can range from £200 to £600, depending on factors such as property value, location, coverage options, and the level of additional cover required (e.g., accidental damage, loss of rental income, public liability).

Insurance premiums will vary from one insurance provider to another, so it’s essential to shop around for the best deal that suits your needs.

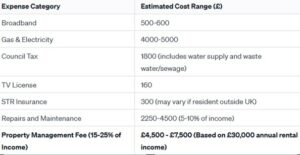

2. Utility Bills, Including Internet

As with any property, utility bills for a holiday let include electricity, gas, water, and internet. The monthly cost may vary depending on usage and the number of guests.

On average, utility bills could amount to £100 to £250 per month. For internet services, you can expect to pay around £20 to £50 per month, depending on the speed and package you choose.

3. Council Tax or Business Rates Property Tax:

The type of property tax you’ll pay depends on whether you are using the holiday home solely for personal use or generating income from holiday letting. If the property is your primary residence and you occasionally rent it out, you may pay council tax.

However, if you operate it as a full-fledged holiday business, you’ll be subject to business rates property tax. The threshold for paying business rates in the UK is currently set at a rateable value of £12,000 or more. Properties with a rateable value below this threshold may be eligible for small business rate relief, reducing the amount of tax payable, or becoming exempt altogether.

Health and Safety Costs:

Ensuring the safety of your guests is of utmost importance. Health and safety costs may include regular inspections, safety equipment, fire and carbon monoxide detectors, and compliance with local regulations.

The expenses for health and safety measures could range from £100 to £300 annually. Specific costs may include:

Gas Safety Certificate: Around £60 to £100 per year

Portable Appliance Testing (PAT): Approximately £2 to £5 per appliance

Fire Risk Assessment: Varies, but may cost between £150 to £300

Carbon Monoxide and Smoke Alarms: Approximately £20 to £50 per unit

Ad Hoc/Unexpected Expenses to Consider

While budgeting for your holiday let, it’s essential to set aside funds for unforeseen expenses. These might include repairs due to sudden damages, equipment replacements, or legal requirements.

Having a reserve of around £500 to £1,000 can provide peace of mind and help you manage such unexpected costs efficiently.

Ongoing Maintenance

Maintaining the condition of your holiday let is crucial for attracting guests and generating positive reviews. Ongoing maintenance expenses may include garden upkeep, appliance servicing, general wear and tear repairs, and window cleaning. Depending on the property’s size and condition, you can expect to allocate around £500 to £1,500 per year for ongoing maintenance.

Decorating and Furnishings

A well-decorated and well-furnished holiday let can significantly impact guest satisfaction and booking rates. While initial furnishing costs can vary widely, budgeting around £2,000 to £5,000 for essential furnishings and decorations is a reasonable estimate. Remember that you may need to replace or update furnishings periodically.

Marketing and Website Hosting

Effectively marketing your holiday let is crucial for attracting potential guests. Marketing expenses may include professional photography, online listing fees, and advertising on various platforms.

Additionally, if you maintain a dedicated website for your holiday let, you’ll need to consider the hosting and maintenance costs. Depending on your marketing strategy, these expenses can range from £200 to £500 annually.

Starting a holiday let and managing it involves several costs, and understanding these expenses will enable you to budget effectively and run a successful holiday home. By factoring in all the potential costs, you can ensure a delightful and profitable experience for both you and your guests.